Ice Dam Damage Insurance Claims Usually Don’t End Well

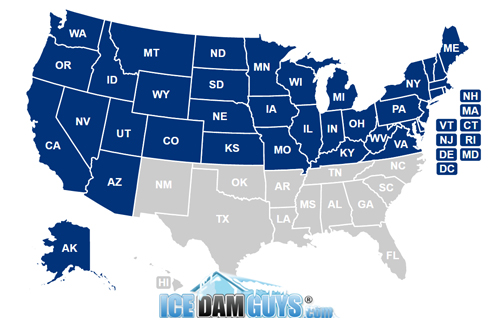

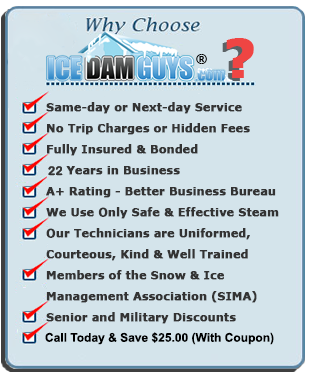

Call us at 1-800-423-3267 if you have an ice dam on your roof and live anywhere in the US, including in hard-hit Alaska. We are properly licensed, bonded, and insured, and are the top-rated ice dam removal company in the US. You can end the leaks with a phone call to Ice Dam Guys®.

Every winter my team has the following conversation again and again:

“Thanks for calling Ice Dam Guys®. How can we help you today?”

“Yeah, how much is it to remove my ice dam?”

We inform them we’ll need to get on the roof to see the ice dam, and we mention our hourly rate and our minimum charge.

“[BLEEP] it, I’ll just let it leak. Insurance should take care of it.”

Turns out insurance doesn’t take care of it. At least not in the way you hope.

Though many insurance companies will pay (to some extent) for damage caused by ice dams, and sometimes the removal of your ice dam, most insurance companies will not pay for ice dam removal. That’s how people go from having sticker shock to thinking a “little” leak doesn’t sound so bad.

That reasoning is dangerous for a range of reasons, but even if your insurance covers some or all of the damage, there’s also a twist: You might get away with that trick once (at most). After that, your insurance company will likely end your coverage, or put you on strict probation. (I mean the kind of probation you’re never about, that your agent will deny exists if you ask about it, and that isn’t discussed openly in the insurance world.) At that point, after your next “tiny” claim you can expect to be non-renewed.

Ice dams and insurance coverage exclusions

An “exclusion” is a special circumstance that releases the insurance company from an obligation to pay your claim. Many policies now have exclusions specifically meant to exclude ice dam damage. That exclusion has gained popularity with insurance companies in recent years. We suspect that’s because of all the people who try to get insurance companies to fork over repair money, rather than just get their ice dam removed and call it a cost of caring for their home.

You’ll find that info in the big policy packet your insurance company sends when you start or renew your policy (the thick packet most people never read). It’s worth pulling up a chair, pouring a drink, and taking the time to go through it – just to make sure your policy hasn’t changed to eliminate ice dam damage from your list of covered events. Tip: Ask your insurance company for a digital copy of your policy. If it’s a PDF you can usually press CTRL+F to search your entire policy for the word “ice dam.”

One strike and you’re out

Even if your policy doesn’t have an insurance exclusion for ice dams you should know that you may only get coverage for ice dam damage once.

Your insurance company may pay that claim, but then they’ll inform you that they will refuse to honor any future ice dam claims. Why? Because at that point they know your home is prone to ice dams. The first leak may have been an accident, but a second leak represents your failure to deal with the underlying problem(s). At least that’s how insurance companies tend to see it, for better or for worse.

Some insurance companies will even cancel your policy if you open too many claims. As you’d guess, a cancellation makes it harder and more expensive for you to get coverage from any other company in the future. Like your home, now you’re damaged goods.

Insurance companies don’t cover negligence

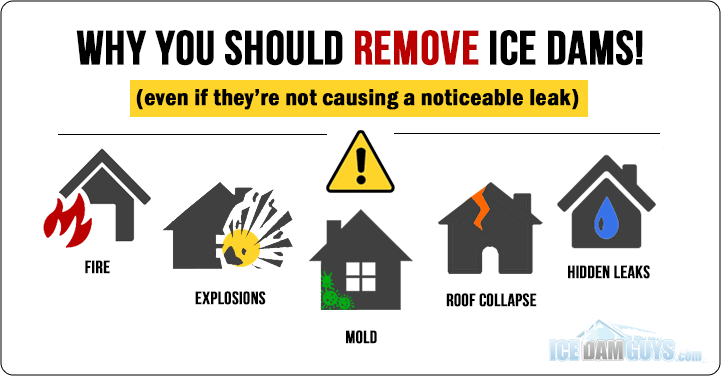

If you saw a glowing ember on your rug, wouldn’t you rush to put it out? We assume you would. You wouldn’t let it burn your whole house down, because you care about your home. You try to snuff out problems, even when a problem isn’t “your fault.”

Insurance companies exist to lessen the blow of unforeseen circumstances, for homeowners who take reasonably good care of their homes. Poor or non-existent home maintenance practices are not unforeseen, and so your insurance company (justifiably) won’t compensate for those. Just as they wouldn’t cover your home if you saw that burning ember on your carpet and you purposefully chose to do nothing about it.

Any problem you encounter, ignore, worsen, or create will affect you more than it will affect your insurance company. You are your home’s first line of defense. If your insurance company sees or thinks that you see your insurance company as the first line of defense, you’re in for a rude awakening.

The damage is always worse than you thought

Your insurance company probably won’t pay to replace your furniture, electronics, clothing, or anything else ruined by water damage that you let happen.

Also, you’ll spend the whole spring dealing with contractors as they work to fix your roof and drywall, and possibly fried wiring. No bueno.

We recommend keeping an emergency fund specifically for ice dam removal, raking the snow off your roof, and taking steps in the warmer months to improve both your roof and the energy efficiency of your home. All of those steps can reduce or virtually eliminate ice dam-related headaches. They take a little more planning, responsibility, thought, time, and money. But it’s all cheaper than the alternative.