Ice Dam Removal Costs & Your Insurance

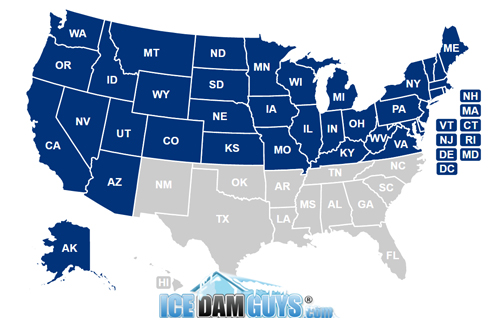

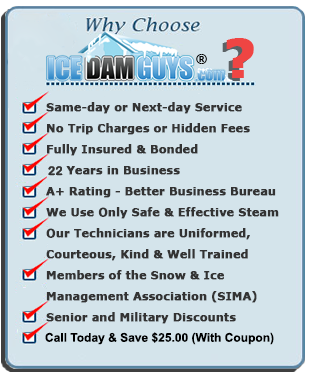

Call us at 1-800-ICE-DAMS if you have an ice dam on your roof and live anywhere in the lower 48, including in hard-hit Minnesota, Illinois, and Wisconsin. We are properly licensed, bonded, and insured, and are the top-rated ice dam removal company in the US. You can end the leaks with a phone call to Ice Dam Guys®.

Image courtesy of community.homeaway.com

When your roof is covered with ice dams, how much of the cost is covered by your insurance?

Your home-insurance company is typically under no obligation to cover ice dam removal costs for you. You’ll discover this if you talk with your insurance agent and/or thoroughly read the “What We Cover” portion of your insurance policy.

But the good news is insurance companies sometimes will cover part or all of your ice dam removal, usually as an act of “good faith.”

Determining your coverage can sometimes feel like you’re trying to figure out Coca-Cola’s secret recipe: All you can do is guess. No two insurance companies are exactly the same in their policies and decision-making. No two ice dams are the same, either: some of them cause enormous damage to your home, whereas others pose little threat.

Therefore, it’s virtually impossible to determine whether or for how much you’ll be covered.

Although you can’t predict your coverage, you can maximize your chances of having at least some of your ice dam removal costs covered – if you know how insurance companies view and handle ice dam claims. Read on.

Jump to a section:

Why aren’t ice dam removal costs typically covered by insurance?

The 6 main factors that determine your coverage

What are your chances of being covered for ice dam removal, and for how much?

Advantage: taking care of “homeowner’s responsibilities” by keeping snow off your roof

Don’t wait until the ice dams cause leaking

Quick recap: best-practices for maximizing your ice dam coverage

Why aren’t ice dam removal costs typically covered by insurance?

Image courtesy of insurance.illinois.gov

The short answer is that ice dams simply are not considered a “covered peril” on most traditional policies.

(A “covered peril” is just insurance-company lingo for a disaster, accident, or type of damage to your home that your insurance covers.)

Note: Not all policies use the exact same language. Typically you can find the “covered perils” of your policy usually under Section 1 / Property / “What We Cover,” and you can usually find what is not covered under the “Exclusions” section. Most policies are written in plain English and are actually quite easy to understand, despite what you may have heard. Although it sounds crazy, it’s a fact that the majority of most homeowners have never once sat down and read through their insurance policy. Take the time to read your policy front to back. You’ll be surprised and what “is” and “is not” covered.

Why doesn’t your insurance company typically pay for ice dam removal? Insurance professionals have explained it to me with the following example:

Ice dams are like a mighty oak tree hanging over the roof of your house. If the tree falls on your roof, your insurance will almost certainly pay for the repairs to your home. The insurance company may even pay to remove the part of the tree that fell on your house (though they typically won’t pay to remove the remainder of the tree in the yard, grind the stump, etc.).

Image courtesy of weatherworksinc.com

However, they’re not going to come out and remove the tree only as a preventative measure. Why? Because there’s a good chance the tree will not fall, and even if it does it may not fall on the house. It would be a slippery slope for the insurance company: they can’t pay for the removal of all the trees that homeowners feel are a little too close to their home. Insurance companies are not in the “tree trimming” business just like they’re not in the “ice dam removal” business. A certain responsibility falls on the homeowner to do their part in protecting their own home. You have a responsibly as a homeowner to show due diligence in protecting and maintaining your home. This is stated in most all insurance policies.

It’s the same with ice dams. Your insurance agency will almost certainly cover the damage done to your home caused by your leaking roof, and they may even pay to remove the portion of the ice dam that’s directly causing the leaking. But typically the removal of the ice dam itself is considered to be the homeowner’s responsibility. Once every blue moon an insurance company may even go so far as to remove the entire ice dam (and sometimes even the snow) from your roof. (This is analogous to their paying for the damage to your home caused by a fallen tree, paying for the removal of the entire tree from your property, and paying for all the debris and the stump to be removed.)

But wait – there’s still hope! Although it doesn’t happen all that often, we’ve been noticing a growing trend in insurance companies that are opting to foot the entire bill for ice dam removal services. Just remember two things (1) The squeaky wheel gets the grease. And (2) You don’t get what you don’t ask for. We’ll explain more about this later in this article, along with other key points to remember when trying to get some “financial assistance” from your insurance company.

On a side note: Keep in mind that If your roof is not actually leaking (causing damage to your home), there’s almost no chance your insurance company is going to pay for preventative ice dam removal. Although we’ve seen it happen a few times over the past 17 years, it’s about as common as a vegan dog.

The 6 main factors that determine your coverage

Insurance companies determine your level of coverage on a case-by-case basis. They are almost never required to cover your ice dam removal, but sometimes they do anyway, and in our opinion this decision is largely dependent on 6 factors:

Factor 1: Your insurance adjuster. If he’s having a bad day because someone clipped his car in the parking lot or because his kid got a D in algebra class, you may get nothing or very little from your claim. Then again, if you hit it off well because the adjuster sees you have the same breed of dog that he has, the deck may be stacked in your favor. The adjuster personally holds a ton of sway, for better or for worse. Butter him or her up with a cup of coffee and non- Chips Ahoy cookies. Don’t for one second underestimate the human element of your insurance coverage. Unless your adjuster is allergic to a little bribery…err, hospitality, you may be on your way to getting extra help with your ice dam removal invoice.

Factor 2: Your insurance agent. Similar story here: Is she willing to go to bat for you to try and squeeze a payment out of the insurance company for you? Or would she rather just sit back and collect her percentage of your monthly premium? It may be that there truly is nothing she can do: Insurance agents hold increasingly less clout with the insurance companies they represent. In the old days, your insurance agent could get just about anything covered if you sent her a nice fruitcake (or even a lousy one) for Christmas every year. Although that’s not as much the case today, your agents still hold some influence over the claim, and a good agent will do his or her best to go to bat for you.

Factor 3: The receptivity of your insurance company to ice dam removal claims. I have never encountered an insurance company that simply covers ice dam removal in all (or most) cases. On the other hand, most insurance companies have paid for some of their clients’ ice dam removal at one time or another. Some companies are more receptive to ice dam removal claims than others are. Whether your company is one of the more-receptive ones is a factor for your claim.

Factor 4: The number of prior claims you’ve had with your insurance company. The more claims you’ve had, the less likely they are to pay for your ice dam removal costs. But if they’ve never had to cut you a check, the chances may be better that they’ll help foot the bill.

Factor 5: How long you’ve been with your current insurance company. Have you been with them for 2 years or for 20 years? This can factor into the company’s decision.

Factor 6: The extent to which you’ve tried to prevent ice dams. For instance, how diligent are you about raking the snow from your roof overhangs and valleys? Although raking or shoveling your roof will not guarantee a “pay day” from your insurance company, it may demonstrate your commitment to avoiding the risks that ice dams pose to your home. This shows that you’re a motivated and responsible homeowner, as opposed to a negligent couch potato who doesn’t tend to his property until something gets damaged and then expects someone else to pay for it. Demonstrated efforts to prevent ice dams may help tip the adjuster a little bit in your favor. If you’ve taken measures to prevent ice dams, be sure to make your adjuster aware of what you’ve done.

What are your chances of being covered for ice dam removal, and for how much?

Your insurance company will decide to handle the costs of your ice dam removal in at least one of 5 ways. They will:

1. Deny your claim altogether (55% chance that this will happen);

2. Pay to remove only the area of ice that is directly causing the water leaks (25% chance);

3. Pay to remove all the ice dams from your roof (15% chance);

4. Pay to remove all of the ice dams and snow from your roof (4% chance), or

5. Pay not only to have your ice dams removed, but also to have your insulation improved or ventilation improved (1% chance).

Alternatively, your insurance company may choose to do some combination of the above.

If they don’t cover all or most of the ice dam removal, see if you can get them to cover at least a little bit of it. Ice dam removal is necessary, but it can be expensive, so every bit of help counts. Just see what you can get.

Your insurance most likely will cover the costs of repairing any interior damage to your home caused by water leaks. As long as you’ve got a leaky roof and water damage on the inside of your home, there’s a decent chance your insurance will at least help to pay for or reimburse you for some of the ice dam removal costs you may have incurred.

Advantage: taking care of “homeowner’s responsibilities” by keeping snow off your roof

As you recall, Factor #6 in determining your coverage is the extent to which you’ve tried to prevent ice dams (as perceived by your insurance company).

They like it if you do everything you can to avoid a situation in which they have to foot any bills – like the cost of removing ice dams.

Image courtesy of squidoo.com/snow-roof-rakes-scrapers

In fact, insurance companies expect you to put fourth an effort to prevent ice dams by making sure you’re your home is adequately insulated, properly ventilated, all attic bypasses are sealed, and that the exterior of your home is water tight and in tiptop shape (i.e., your roof). During winters with epic amounts of snow, they throw something else on your plate that you may or not be aware of. Shoveling and/or raking your roof! Although we couldn’t find one policy that stated explicitly that homeowners are required to shovel or rake their roofs, most insurance policies state in some oblique way that roof-raking or shoveling the snow off your roof is part of regular and necessary home “upkeep.”

Regardless of the extent to which you fulfill your “responsibility” to keep your roof snow-free, the insurance company most likely is still not required or obligated to pay one penny for ice dam removal.

But in our experience, if you can show the adjuster that you’ve gone to lengths to keep your home free of ice dams by having kept all or part of your roof snow-free, he or she may be more inclined to cover some or all of your ice dam removal expenses.

Keeping your roof clear or partially clear of snow may give you the edge you need to get some financial assistance if and when ice dams wreak havoc on your home or business.

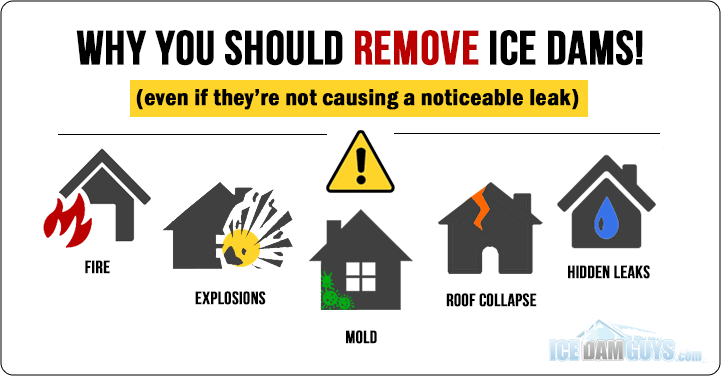

Don’t wait until the ice dams cause leaking

That may sound like a “duh” piece of advice, but I’ve seen a surprising number of people take a bit too much comfort in the fact that their insurance almost always covers water damage caused by ice dams. They forget that although the damages to their home are typically covered by insurance, any damage to or loss of valuables inside the home may not be covered. It’s very easy for a “wait it out” approach to backfire. We’ve seen this happen all too many times!

Pictures, family heirlooms, furniture, or your shiny new plasma TV can easily get damaged or destroyed by water leaks – and certainly by a roof collapse. Your insurance may or may not reimburse you for these items; it just depends on your specific policy and its limits. (Obviously, some possessions can’t be replaced by any amount of money.)

Here’s a scary fact a lot of people don’t realize: Any time water leaks into your home you have a fire hazard on your hands. You may not even notice a leak in your roof, especially if the insulation is soaking up the water. Wet electrical wires throughout your attic and wall cavities can spell disaster for your home and finances. Water damage means more bills. Fire damage means you were lucky to have only a small part of your home go up in flames.

Here’s a scary fact a lot of people don’t realize: Any time water leaks into your home you have a fire hazard on your hands. You may not even notice a leak in your roof, especially if the insulation is soaking up the water. Wet electrical wires throughout your attic and wall cavities can spell disaster for your home and finances. Water damage means more bills. Fire damage means you were lucky to have only a small part of your home go up in flames.

Then there’s the issue of mold. Ice dams can cause water leaks, and those leaks can spawn mold.

Mold is impossible detect in its infancy. Why? Because it forms out of nothing more than (usually) wet insulation or wood. And it looks and smells like nothing more than wet insulation or wood. It can’t be detected because it’s not mold…yet.

Very few contractors have the very expensive equipment to locate areas inside the cavity of your walls, attic, etc. And even if they do, it can be nearly impossible to detect areas deep inside a wall cavity or in the far corner of your crawl space. The same is true of insurance adjusters. Rarely will an adjuster show up to your home and whip out his $25,000.00 FLIR T640 thermal imaging camera and begin a clean sweep of your entire home from top to bottom, edge to edge. Not only is that not his job to begin with, but can you imagine what it would cost to equip thousands of adjusters with this type of device? It would be up to you, the homeowner, to hire a reputable thermal-imaging specialist to perform this service.

Even if you called the best infrared thermographer around, he or she can’t guarantee that your home is free of any excess moisture. As sophisticated as these infrared cameras are, it takes a trained eye to detect even the small amount of moisture that can lead to rampant mold. Not only is mold ugly and smelly, but it can cause short-term irritation and, in some cases, longer-term health issues. The water leaks from your ice dam may very well not lead to mold…but they may. Minimizing the risk of mold is yet another reason not to play chicken with your ice dam(s).

It also pays to avoid water leakage because you’d prefer not to file a claim at all, even if you end up getting the coverage you want. In most cases you’ll pay for it in the form of increased rates – for many years to come. The insurance company will almost always get its money back eventually, one way or another. Can’t you just switch companies? You can, but you probably won’t save any money: Like your credit history, your claims follow you everywhere.

However, most people don’t want to have to file a claim and do want to preserve their home. They’ll try their best to prevent ice dams from forming in the first place, and will typically get the ice dams removed if they do form. That’s certainly the approach I suggest, but however you choose to handle an ice dam problem, at least make sure your valuables are out of harm’s way.

Last but not least, your insurance company may be more likely to cover some of your ice dam removal costs if you get your ice dams removed sooner rather than later.

Remember how I said that you’re more likely to get some help from your insurance company if you show a good-faith effort to prevent ice dams in the first place? Well, that also extends to what you do if you do get an ice dam, and when you do it. That tells your insurance company something about your sense of responsibility.

It may be tempting to think, “If my insurance company won’t pay to have my ice dam removed, but they will pay for the damage it does to the interior of my home, to heck with it it, I’ll just let it leak and let the insurance cover the repair.” Bad idea. Your insurance company probably will deny your claim for the repairs. They know the risks of waiting (e.g. water, fire, mold). To them, it looks like you’d rather have your house take a beating than to spend some possibly-uncovered money to avoid that damage. After they deny your claim, they may even go so far as to cancel your policy.

Quick recap: best-practices for maximizing your insurance coverage of ice dams

- Remember that your insurance company will only cover ice dam removal at their discretion. Your task is to get on their “good side” every way you can. (Be sure to enlist the aid of that coffee, plate of homemade cookies, or libation of choice!)

- Try to get off on the right foot with the insurance adjuster (who holds a lot of sway over your claim). In general, be kind; don’t treat the insurance company as an adversary.

- Make at least a little effort to get to know your insurance agent. Your agent can help your claim.

- Remember that your history with your insurance company is a factor—particularly how long you’ve been with them and how many claims you’ve filed.

- Be diligent in your efforts to prevent ice dams by raking or shoveling your roof.

- If your insurance company doesn’t cover most or all of your ice dam removal, see if they can cover some of it. Don’t be afraid to haggle a little.

- Don’t wait until there’s water leaking into the interior of your home to get the ice dams removed. This can lead to water damage (or even fire damage), as well as to an outbreak of mold.

- Remember that although damage to your home will almost always be covered, damage to any valuables may not be covered. Keep what’s inside your house safe.

- Remember that your insurance company takes into account every action or inaction of yours to prevent (1) ice dams from forming and (2) the damage caused by ice dams that do form. Your concerns and motives show.

To learn more about ice dams, please visit our Learning Center. To learn more about ice dam removal, see our FAQs page. For help from America’s top-rated ice dam removal company, please contact us, Ice Dam Guys®.